The world must change fundamentally if greenhouse gas emissions are to be reduced quickly and permanently. The energy and industry sectors are hugely important as they are responsible for around one quarter of these emissions. The alternatives to fossil fuels are nuclear power and hydropower as well as renewables, the main problem with the latter being their intermittent availability. It is not constantly sunny or windy, so, without storage capacity it is not possible to generate a steady supply of power 24/7. This is where batteries come in.

The evolution of the modern battery has come a long way since Alessandro Volta invented the voltaic pile in 1800, which consisted of a stack of copper and zinc discs separated by brine-soaked cardboard. Scientific progress has gone from the era of voltaic cells and the advent of lead-acid batteries to alkali batteries and finally to the lithium-ion batteries that are very common today. These innovations made it possible to put portable batteries into electronic devices and, now more than ever, are a fixture of everyday life. The strong interest in electric mobility and renewables emphasises the need to be able to store energy, and is driving the development of new and better technologies. Battery life needs to be longer, costs must be reduced, and battery power density and the amount of recyclable material have to be increased.

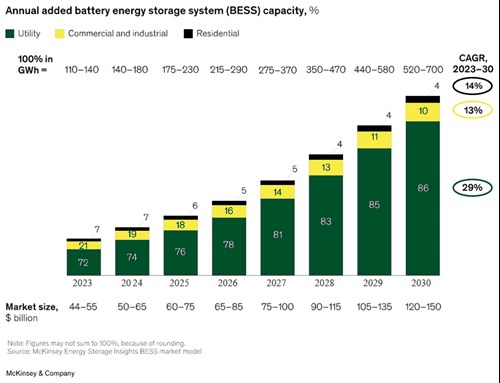

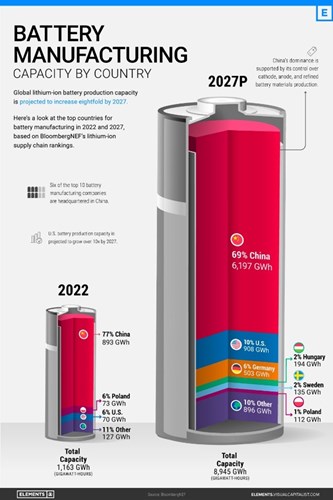

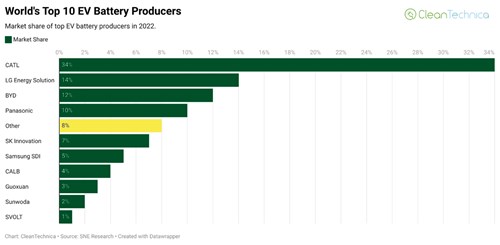

The market leader CATL launched its new lithium ferrophosphate (LFP) battery for electric vehicles in August of this year, which it claims can recharge 400 kilometres of range in only 10 minutes and is thus making the industry sit up and take notice. Further high levels of growth are expected in the battery market in the coming years, thanks in part to political support. While, in Europe, the energy crisis has created an added incentive, in the US, the Inflation Reduction Act passed in 2022 is disbursing more than 370 billion USD for investment in clean energy. China is benefiting from this now and into the future, as the country is not only home to the technology market leader but also the frontrunner in gigawatt hours produced. However, the mining and processing of lithium is at least as important as the manufacture of batteries, and, in this area, Australia and Chile are first and second, respectively, ahead of China. The figures show how far behind Europe is in relation to relevant commodities and technologies of the future and, in the wake of the energy crisis of the past year, raise questions about the future role of Europe.

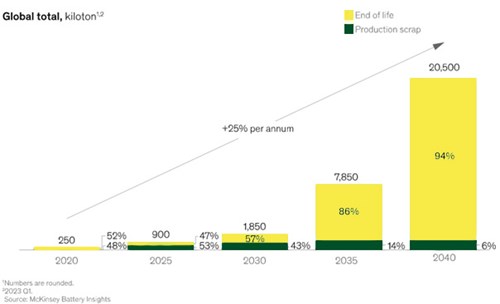

However, the new EU Battery Regulation (BATTVO) passed in July has already found solutions to battery recycling and will form the basis for structural growth in this market. It is the first piece of legislation that aims at taking a full-life-cycle approach. With its provisions on removability and replaceability as well as recycling efficiency, it supports the circular economy and thus the battery recyclers. The German End-of-Life Vehicle Regulation and the Battery Act already provide that waste batteries from electric vehicles (“industrial batteries”) cannot be land-filled or incinerated. The increasing electrification of the automotive industry is therefore likely to lead to increased demand for recycling capacities in future. The scarcity of certain raw materials – such as cobalt, nickel and graphite – which go into battery cells should lead to increased interest in the battery circular economy if the market grows as expected. One problem at the moment is that too few EV batteries are entering the recycling stream for recycling plants to be commercially viable at this point in time. Given what we know today about the durability of accumulators, it is therefore likely to take the recycling industry a number of years for large plants around the world to reach capacity despite the fact that EV sales are exploding. This is the reason why companies such as Aurubis are starting off with pilot plants rather than industrial-scale plants.

In Germany, car makers such as Tesla, BMW, Volkswagen and Hyundai typically provide an eight-year warranty on the battery as well as a certain capacity. Since accumulator degradation figures currently indicate that, in most cases, at least 80% battery capacity is left after eight years, we cannot expect significant quantities of batteries to be recycled for around ten years. Therefore, based on historical unit sales, we can expect a dynamic increase in demand from 2027. According to Statista, the global fleet of electric cars has ballooned from 3.4 million in 2017 to 27.7 million in 2022. However, the regional focus of the circular economy in terms of volume is likely to be China, where one in every two electric cars worldwide is being sold of late. In 2022 alone, 6.5 million electric cars were sold. BYD knocked Tesla off top spot for sales of new vehicles. To make an assessment about future profitability, it is essential to consider the trend in the prices of the key materials in addition to sales volume. Even though the prices of lithium as well as heavy metals such as nickel, cobalt and manganese can be expected to rise in the long term, the trend in prices remains very volatile and thus hard to predict. While the market is very new, early investment would seem to make good business sense due to scale effects. Given the structure of long-term supply contracts for battery cells for future car models, it is necessary to establish partnerships for the return of end-of-life batteries at an early stage. Another potential positive side effect is security of supply for the manufacturers of new batteries. Since certain raw materials are likely to remain scarce in the long term, having a certain percentage of recycled materials can reduce the procurement risk. From a marketing point of view, having a high proportion of recycled materials is positive for EV sales.

In principle, there is already enough visibility for a long-term investor to participate in the growth opportunities of battery recycling. The investments being made by many companies along the battery value chain reinforce the assumption that some of the value added of battery cells will be in the circular economy. For example, lithium producer Ganfeng has invested in the recycling of 70,000 tonnes of end-of-life batteries. Its target lithium recovery rate from the waste battery cells is 90%. Although the world’s largest battery manufacturer CATL is not planning any recycling plants in Europe, it does operate in the US through its partner BRUNP. In addition, at the beginning of the year, CATL announced an investment of 23.8 billion CNY (around 3.2 billion USD) in the expansion of its recycling plants in Foshan, southern China. Successful companies in the area of electric mobility show, however, that it can be an advantage to operate at multiple points along the value chain. For example, Tesla has ensured a very high degree of in-house production for its vehicles, right up to the battery management system and the manufacture of the cells. BYD also has broad vertical integration, with its own cell and even chip production. BYD is planning to use end-of-life batteries from electric cars for stationary battery storage systems and is thus making a further contribution to the circular economy.

In summary, both the battery and the battery recycling market and the associated value chain offer interesting investment opportunities for the future, which are hugely important in transitioning to a world and an economy with lower greenhouse gas emissions.